We would all like to have a time machine to go back to pick up an under-appreciated supercar back in the 90s, buy it and bring it back to today. Many elite enthusiast cars (and other types of cars) also lost their value in the 2008 recession and hit rock bottom.

Since then, the used car market has gone crazy and prices have more than rebounded, and just like bitcoin, there’s no going back.

Even then, prices for supercars were likely still more than the average blue-collar worker could afford, but perhaps more within range of those with a prescient mind and some life savings.

Doug DeMuro on YouTube returns along with close friend Kenan to leaf through some 2008–2009 copies of the DuPont Registry to see how badly hedge-fund managers wanted to move on their exotics as the recession sank its teeth in.

These Are The Most Affordable Supercars If You Are In 2008

Of course, a lot of people lost cash and found life harder following the stock market collapse, but there were presumably those who could profit and grab some icons for less.

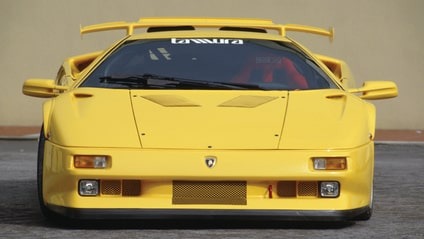

A 1991 Lamborghini Diablo with 30,000 miles and a major service carried-out with a new clutch is only $84,000 – today they are worth an average of $173,000 with many worth much more.

Ferrari’s legendary F50 is worth only $949,000 in 2009, but today it will set you back around $4 million – that’s a 400% increase, and $3 million back in your pocket.

This Is The Cheapest Supercar To Buy In 2008

Ferrari F40, side view on road at speed

Via: Ferrari$3 million spread over 14 years is around $214,000 – that’s how much it appreciated on average each year to today. If you worked that out to a monthly salary that would be $17,000 a month.

There are some more surprises in the DuPont dive-in, such as a 1992 Ferrari F40 which went up from $599,000 to today’s average value of $2.3 million, and other cars including a Jaguar XJ220 for $232,000; now it’s worth $600,000 on average.

With car prices going up and up, it would still make sense to put your money in enthusiast cars today, although the wins will be low, and there is always potential for outside events to create dips in the market.

Supercars also need to have the yearly maintenance and suitable storage, plus insurance and some kind of security measures in place. Mileages should get kept low to invest cash in cars, but the beauty of putting your money in a car instead of stocks is that you can look at them.